News

Why Shuttlecock Prices Are Surging in 2025 – And Why OEM Shuttlecock Manufacturing Is the Key for Buyers

In 2025, the global badminton market is facing an unprecedented price shock. What was once considered an affordable mass sport has become noticeably more expensive for clubs, training centers, and even casual players.

Training-grade shuttlecocks that used to cost around USD 12–15 per tube have doubled in price. Premium tournament shuttlecocks now exceed USD 10 per piece in many markets. For some amateur players, the cost of shuttlecocks for a two-hour session is already higher than court rental fees.

Behind this price surge lies a deeper structural change across the badminton supply chain—one that is reshaping how buyers source shuttlecocks and why OEM shuttlecock factories in China are becoming increasingly important.

The Real Reason Shuttlecock Prices Keep Rising

1. Feather Raw Material Shortages

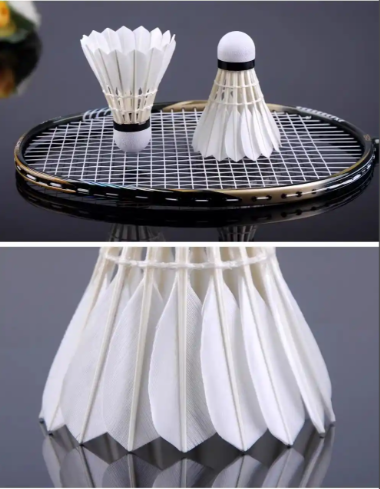

A standard feather shuttlecock requires 16 perfectly matched feathers, all taken from the same side wing of ducks or geese. In practice, producing one qualified shuttlecock often consumes feathers from two to three birds.

High-grade goose and duck feathers—especially wing tip feathers—are becoming harder to secure. Poultry farming cycles, disease risks, and changes in meat consumption patterns have significantly tightened supply. Since feathers account for 70–90% of shuttlecock production costs, even small disruptions upstream create sharp price increases downstream.

2. Labor-Intensive Manufacturing Cannot Be Replaced

Despite automation advances, shuttlecock production still relies heavily on skilled manual labor. Processes such as feather sorting, trimming, inserting, stitching, gluing, and flight testing require experienced workers.

In major production regions such as Anhui, labor costs now account for 15–20% of total manufacturing costs. At the same time, environmental compliance and wastewater treatment investments continue to rise, further compressing factory margins.

3. Demand Is Growing Faster Than Supply

Badminton participation continues to expand rapidly. In China alone, the number of active players has surpassed 250 million, with particularly strong growth in youth training and amateur competitions.

High court utilization rates, year-round tournaments, and institutional training programs have created consistent, non-seasonal demand for shuttlecocks. This demand pressure allows cost increases to pass through the market more easily.

Why Buyers Are Turning to OEM Shuttlecock Manufacturing

As branded shuttlecock prices climb, more buyers are rethinking their sourcing strategies. Rather than relying solely on established brands, clubs, distributors, and emerging labels are shifting toward OEM shuttlecock solutions.

Working directly with a professional OEM shuttlecock factory allows buyers to:

Control feather grades based on real usage needs

Optimize durability for training vs competition scenarios

Reduce brand premium costs

Customize speed, weight, and packaging for local markets

Secure a more stable long-term supply

For high-consumption users, OEM sourcing is no longer just a cost-saving option—it is a supply-risk management strategy.

OEM Shuttlecocks vs Synthetic Alternatives

Synthetic shuttlecocks, including those made of carbon fiber and plastic, are gaining attention due to their improved durability and humidity resistance. However, most players still prefer natural-feather shuttlecocks for their flight stability, descent control, and traditional feel.

As a result, synthetic shuttlecocks currently serve as supplementary products, while OEM feather shuttlecocks remain the mainstream choice for training systems transitioning players toward competition-level performance.

How Reliable OEM Shuttlecock Factories Are Adapting

Leading OEM shuttlecock manufacturers in China are responding to market pressure through:

Vertical integration with feather sourcing partners

Stricter feather grading and matching standards

Process optimization to improve durability per unit cost

Flexible MOQ and private-label support for overseas buyers

Factories with strong upstream control and experienced production teams are better positioned to help buyers navigate price volatility without sacrificing performance consistency.

The Future of Shuttlecock Sourcing

Shuttlecock price increases are not a short-term anomaly—they reflect bigger structural changes in raw materials, labor, and global demand. While prices may stabilize, a full return to historical lows is unlikely.

For buyers seeking long-term stability, partnering with a reliable OEM shuttlecock factory in China offers a practical path forward: predictable quality, controlled costs, and scalable supply.

In a market where every feather matters, smart sourcing decisions will define who remains competitive in the years ahead.